how much is my paycheck after taxes nj

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the. Open an Account Earn 17x the National Average.

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

No monthly service fees.

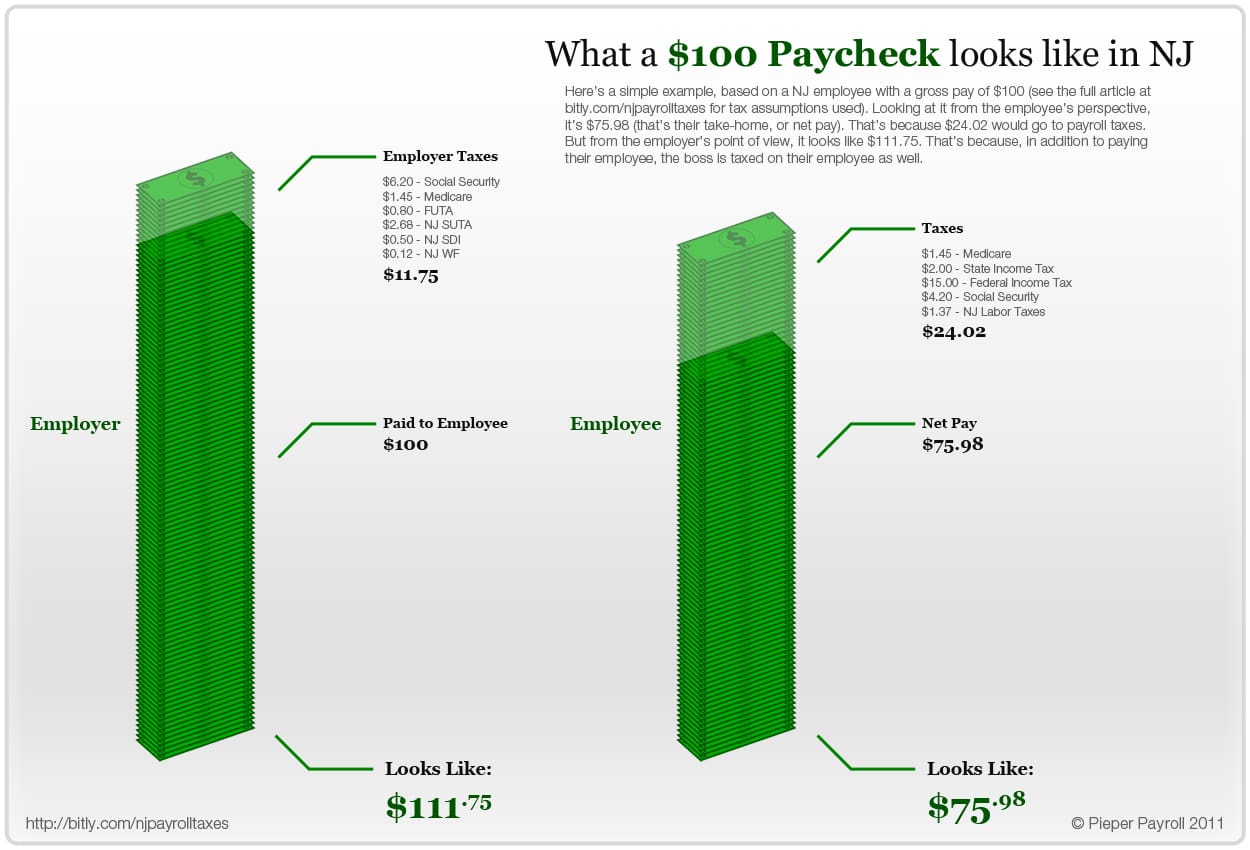

. If a taxpayer claims one withholding. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to.

NJ Tax Calculations Click to view a salary illustration and print as required. Easy 247 Online Access. Assuming a top tax rate of 37 heres a look at how much youd take home after taxes in each state and Washington DC if you won the 19 billion jackpot for both the lump.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 217 and your marginal tax rate is 360. Paycheck Deductions for 1000 Paycheck For a single taxpayer a 1000 biweekly check means an annual gross income of 26000.

Just enter the wages tax withholdings and other information required. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. New Jersey New Jersey Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal.

The current rate for Medicare is 145 for. Enter your salary or wages then choose the frequency at which you are paid. Easy 247 Online Access.

It may not end there however as the windfall could raise your tax rate to the maximum 37 which kicks in for single taxpayers making over 53900 in 2022 and married. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. If a taxpayer claims one withholding.

No monthly service fees. Paycheck Deductions for 1000 Paycheck For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. The current rate for Medicare is 145 for.

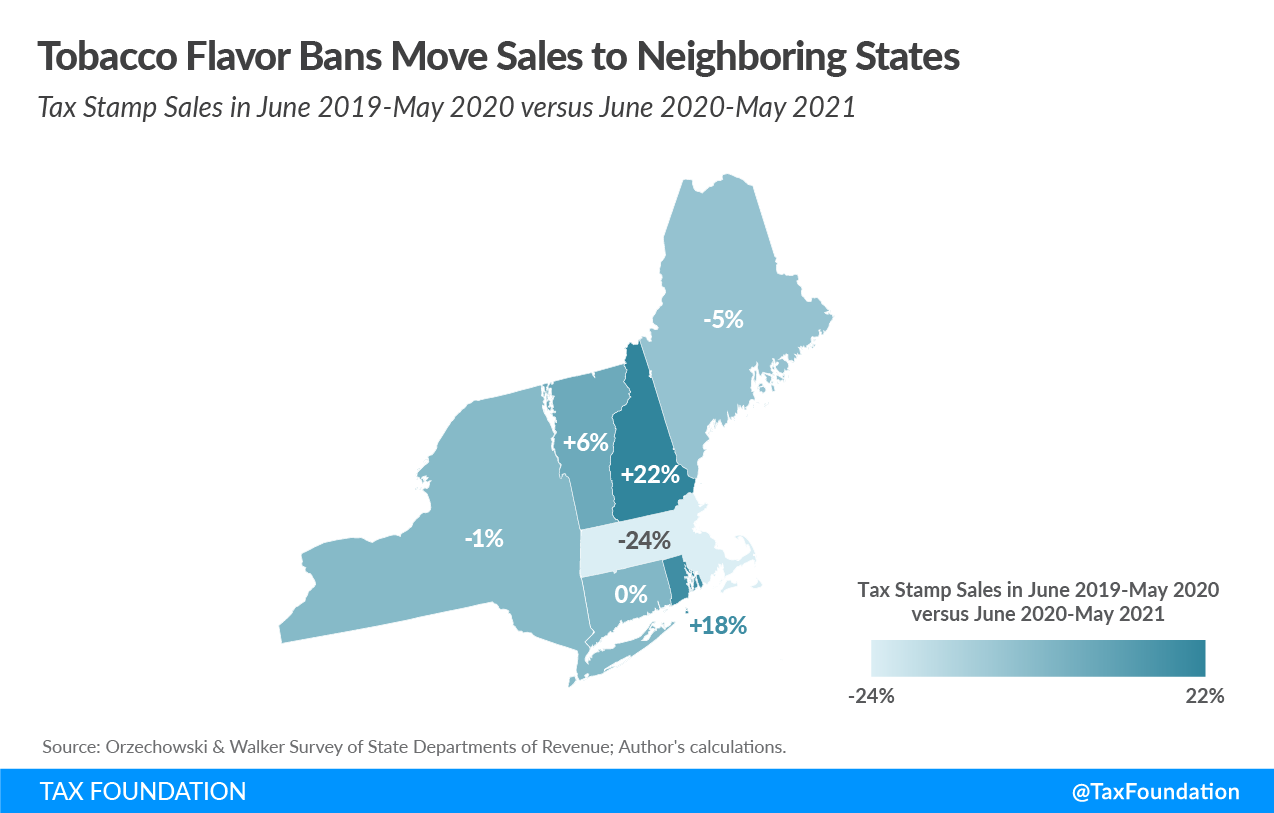

1000000 Salary Calculation with Graph. Employers will also need to pay unemployment insurance or SUTA state unemployment tax. New Jersey announces new rate tables each year which can be found at the New Jersey.

Open an Account Earn 14x the National Average. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

For instance an increase of. The previous record Powerball pot. After 40 consecutive drawings theres been no winner for the Powerballputting the new jackpot at 204 billion the largest prize in history.

500000 Salary Calculation with Graph. While the tax rate is 499 in 2022 it will go down to 475 in 2023 then to 460 in 2024 then to 450 in 2025 then to 425 in 2026 and finally down to 399 after 2026. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

N J S New Anchor Property Tax Program Your Questions Answered Nj Com

What Are Employer Taxes And Employee Taxes Gusto

Nj Div Of Taxation Nj Taxation Twitter

Here S How Much Money You Take Home From A 75 000 Salary

Nj Division Of Taxation Employer Payroll Tax

State Individual Income Tax Rates And Brackets Tax Foundation

Tax Collector Manalapan Township

What Is Local Income Tax Types States With Local Income Tax More

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

New Jersey State Tax Guide Kiplinger

Paycheck Calculator New Jersey Nj Hourly Salary

Property Taxes City Of Jersey City

New Jersey Income Tax Calculator Smartasset

New Jersey Paycheck Calculator Smartasset

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara