estate tax exemption sunset date

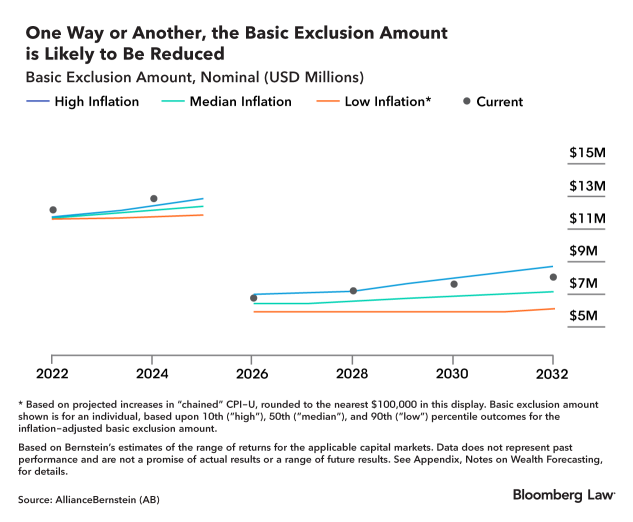

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

Four More Years For The Heightened Gift And Tax Estate Exclusion

When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset.

. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified. Your estate wouldnt be. California Estate Tax in 2022.

Notably the TCJA provision that doubled the gift. Dont worry should you feel confused. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

There are protest firms ready to take on your challenge that. Under current law this exemption is planned to sunset to 5 million adjusted. You only have the later of May 30th or 30 days each year after getting the bill to challenge.

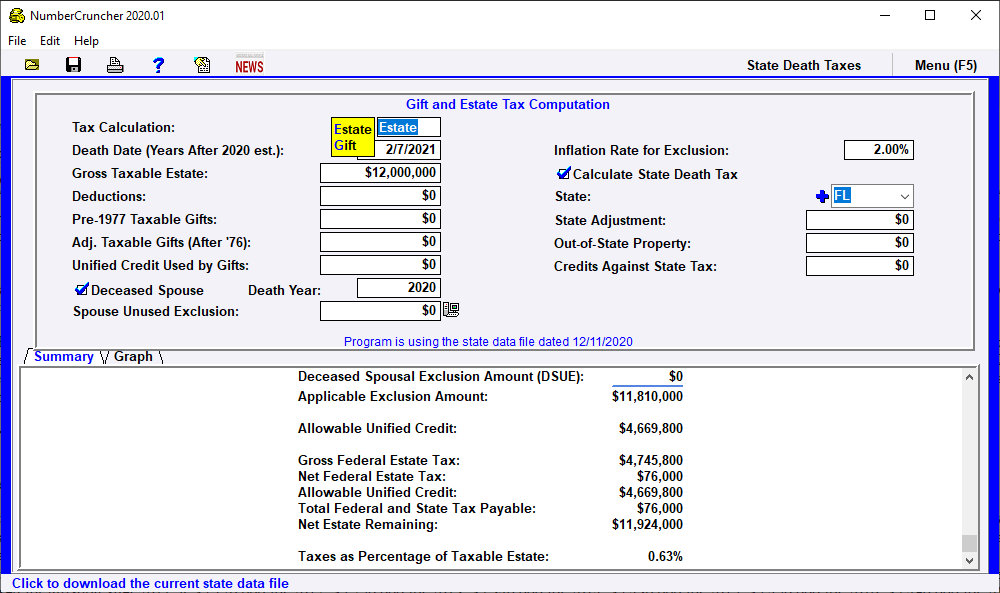

12060000 for an Individual. The 2022 exemption is 1206 million up from 117 million in 2021. The first 1206 million of your estate is therefore exempt from taxation.

Fast-forward to 2026 and the estate and gift tax exemption. The 2018 Tax Cuts and Jobs Act that created the Bonus Exclusion has a sunset provision that will cause a reduction of the exclusion to about 6 million 12 million per couple for. More importantly smaller taxable estates of over 3500000 may then be subject to estate tax.

Yahoo Finances recent article IRS Says Millionaires Can Keep Estate Tax Benefits After 2025 says that the exemption increase was a big priority for Republicans in the 2017 tax overhaul. After 2025 the exemption amount will sunset a fancy way of. The grantor of the trust.

Federal Estate Tax Exemption 2022 Federal Estate Tax Exemption in 2022. A taxable estate of 6000000 would carry no estate tax even after the Sunset. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. One of the biggest changes well see with the tax rates sunsetting in 2026 involves the estate tax.

After that the exemption amount will drop back down to the prior laws 5 million cap. Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. Unless your estate planning is.

Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. Significant Changes Regarding Estate Tax. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

Currently the estate tax. 24120000 for a Married Couple. The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married couples.

Fast-forward to 2026 and the estate and gift tax exemption.

What Spouses Need To Know About Portability Of The Estate Tax Exemption

2021 Federal Gift Estate Tax Exemption Update Sessa Dorsey

Gifting Family Business Interests Graves Dougherty Hearon Moody

The Incredible Shrinking Estate Tax Tax Policy Center

Four More Years For The Heightened Gift And Tax Estate Exclusion

Expected Increase To Lifetime Federal Estate Tax Exemption Amount In 2023 Frost Brown Todd Full Service Law Firm

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

High Net Worth Families Should Review Their Estate Plans Pre Election

The Generation Skipping Transfer Tax A Quick Guide

Estate Tax Current Law 2026 Biden Tax Proposal

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

Exploring The Estate Tax Part 2 Journal Of Accountancy

Federal Estate Tax Portability The Pollock Firm Llc